Hyderabad:The Annual Union Budget 2022, which is to be presented by the Union Finance Minister Nirmala Sitharaman on February 1, is unusually pivotal considering the current state of the economy that's severely affected by the ongoing pandemic. Although the third wave of the pandemic is going fairly mild on the masses, it definitely hasn't helped in improving the economic adversities in the country. Moreover, the upcoming elections scheduled amid the budget session will make it crucial for the Finance Minister to hatch out a budget that satisfies the masses not just on a radically economical level but also on a layman level.

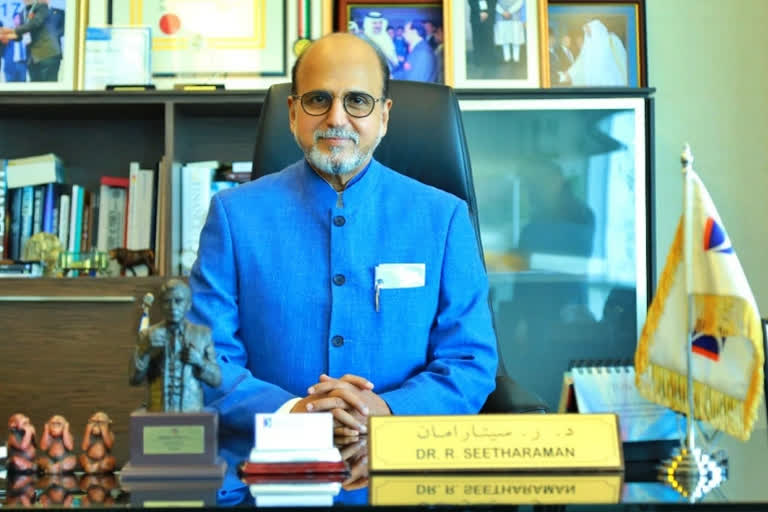

Dr R. Seetharaman, Group CEO of the Doha Bank in Qatar, explains in detail about the expectations from the upcoming budget on both a micro and macro level. The overall budget of the year, he says, is expected to focus on employment generation, promote national digital health mission via telemedicine, increase in corporate and infrastructure Capex via PLI allocations, incentives for digital growth and take bold steps to address the decarbonisation measures.

Taxpayers' Expectations

While the economy still remains a complicated matter for most laypersons in the country, the Union Budget most definitely affects all of their lives. The steering wheel of the economy is, in fact, under the laypersons' ultimate control since they are the sole taxpayers. As the budget approaches, here is an insight into some key factors that will directly impact the economic dynamics in India, ultimately reflecting on the taxpayers' personal lives.

Rationalisation of tax slabs is the first and foremost thing that is being expected from the coming budget session, in a direction that may bring relief to the taxpayers from all the sections of society. Secondly, the increase in the basic exemption limit from Rs 2.5 lakh to Rs 3 lakh is also a crucial expectation, especially when there barely have been any changes in the exemption limit since the past several years.

The 'Work from Home' allowance amid the emerging new work culture has also attracted all eyes to it. As the digital economy is progressing to become the new cool, the introduction or clarity on taxation of cryptocurrency transactions is also something that several of the young investors and taxpayers would be keen on having addressed in the budget. Furthermore, the employed population will also look forward to the expansion of Metro cities list for 50% HRA exemption and calculation for salaries, as most of it is concentrated in the metro cities in the country.

Digital Economy and Digital India

With technology gradually taking over the kingpin seat in the economy, the budget is also expected to put the digital economy in a smoother motion. The number of internet subscribers in India currently stands at around 750 million, expected to grow to 900 million by 2025. The digital economy continues to drive growth in domestic as well as export markets, making it an important aspect to be addressed in the budget.

E-commerce players incur heavy Advertisement Marketing and Promotion (‘AMP’) expenses towards the promotion of their products. However, the tax authorities have been treating such AMP expenses as ‘brand building’ and capital in nature, even though the benefits of such expenses are short-lived.

The BJP government has been exceptionally keen on the Digital India Initiative, the resultant of which the Finance Minister has readily focused on the objectives of the initiative in the past as well as in the upcoming budget. Some of the crucial objectives that are expected to be emphasized in the upcoming session include the development of a stable and secure digital infrastructure, the digital delivery of government services, and the promotion and execution of Universal Digital Literacy.

Green Hydrogen Economy

With Climate Change being one of the many undermined factors that just cannot be ignored anymore, it has become an unsolicited compulsion for all economies across the world to incorporate a greener approach in their strategies. Green Hydrogen is a critical piece of energy transition enabling India to achieve its energy security objectives and net-zero commitment, though it also needs cost-effective storage and delivery systems.

The budget session is expected to chalk out plans to present clarity on the viability gap funding focused on Green hydrogen projects that enable low carbon steel, cement, trucking and maritime shipping. A purchase guarantee mechanism to buy back excess renewable electricity can generate alternate revenues for investors and reduce the overall cost of production, making it a crucial economic asset.