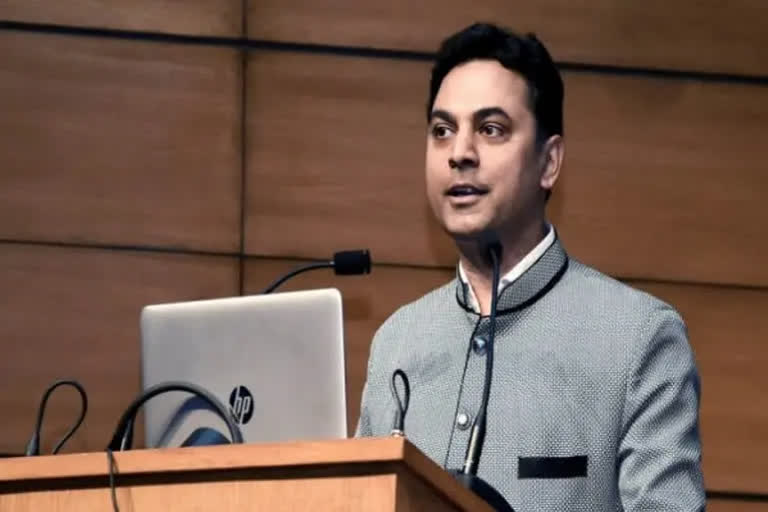

New Delhi:Chief Economic Adviser (CEA) K V Subramanian on Tuesday exuded confidence that India would achieve double-digit growth in the current financial year on the back of policy initiatives and continuing reforms.

He also said the country is well poised to meet the fiscal deficit target of 6.8 per cent of GDP.

"At this stage, I can say confidently that we should be able to achieve that fiscal deficit number. Any shortfalls that might happen on the disinvestment side will also be accompanied by positive surprises that have happened on tax revenue," he told reporters.

The government estimates fiscal deficit at 6.8 per cent of the gross domestic product (GDP) for the current financial year ending on March 31, 2022.

Subramanian, who would be demitting office after completing his three-year stint next month, added, "India is likely to have double-digit growth this year. The overall growth for the first half has been 13.7 per cent, so even a little more than 6 per cent growth in the subsequent quarters should be able to deliver double-digit growth for this year."

India's GDP growth stood at 8.4 per cent in the second quarter of 2021-22, with the economy surpassing the pre-COVID level, official data showed on Tuesday.

The Economic Survey 2020-21, released in January this year, had projected GDP growth of 11 per cent during the current financial year ending March 2022.

The Survey had said growth will be supported by supply-side push from reforms and easing of regulations, infrastructural investments, boost to manufacturing sector through the Production-Linked Incentive (PLI) schemes, recovery of pent-up demand, increase in discretionary consumption subsequent to rollout of vaccines and pick up in credit.

Also Read:Indian economy grows 8.4 pc in July-September, surpasses pre-COVID level

"We are projecting 6.5-7 per cent (growth) next year and thereafter 7 per cent plus over different scenarios. I think the impact impact of seminal second generation reforms will unfold in terms of both investment and in productivity going forward," he said.