New Delhi: The state-owned dedicated development financing institution (DFI) will be able to arrange Rs 10-12 lakh crore for the Centre’s ambitious national infrastructure pipeline (NIP) project that aims to completely overhaul the country’s infrastructure by funding 6,000 infrastructure project in next five years at an estimated cost of Rs 111 lakh crore, said finance minister Nirmala Sitharaman.

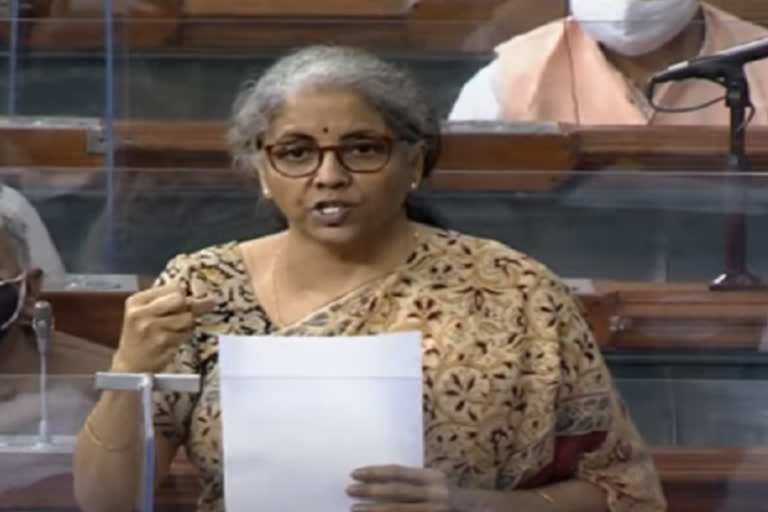

While responding to the queries of the Lok Sabha members, the finance minister underscored the need for creating a new government-owned entity to meet the long term financing needs of infrastructure projects such as rail, roads, highways, airports and seaports which cannot be met by ordinary commercial banks.

Finance minister Sitharaman urged the Lok Sabha members to clear the National Bank for Financing Infrastructure and Development Bill, 2021 as the bond market in India was not mature to provide long term funding needs for the national infrastructure pipeline (NIP) and it was not possible for the government to fund these 6,000 projects through taxpayer’s money.

“Six thousand projects, both Greenfield and Brownfield projects worth Rs 111 lakh crore are in pipeline. Obviously, that is the kind of money that is required for India's infrastructure building that purely public funding cannot meet,” the finance minister said.

Nirmala Sitharaman said arranging this kind of money from taxpayers or the government’s own resources was not possible.

“If we only depend on the taxpayer's money and the government's resources then it might take 100 years by the time we even reach all the six thousand projects,” she told Lok Sabha members.

“In India, the corporate bond market is not mature, it is not really deep enough so we are in no position to say that the bond market will be able to take care of our long term project financing need,” said the finance minister.