New Delhi:The Congress on Wednesday alleged the Modi government was showing leniency towards fugitives and cited the RBI’s new policy allowing settlements to willful defaulters.

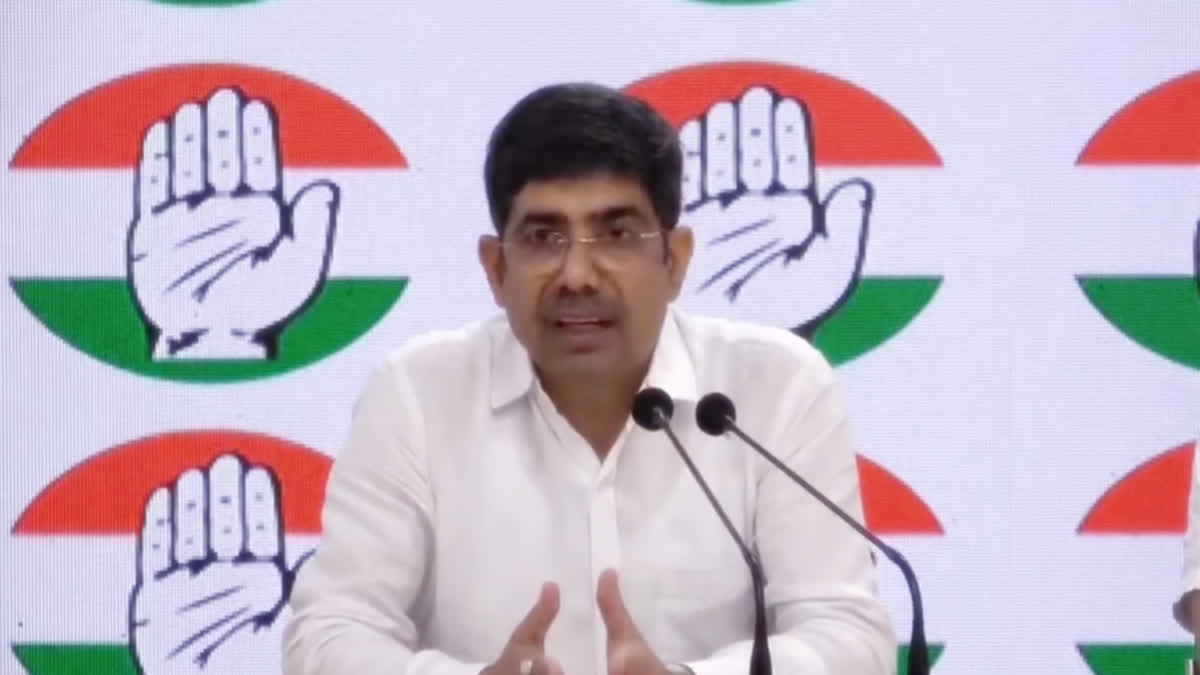

“Why is the Modi government being lenient with willful defaulters? On June 8, 2023, the RBI notified the Framework for Compromise Settlement and Technical Write-offs. The RBI issues directives that the banks and other regulated entities may undertake compromise settlements and technical write-offs in respect of accounts categorized as willful defaulters or fraudsters without prejudice or criminal proceedings. This means the banks have now been allowed to work out a compromise with the willful defaulters,” AICC spokesperson Amitabh Dubey said.

“The Modi government has been favouring the big defaulters and fraudsters, especially the Adani group. Through the new rule the government is providing safe passage to the willful defaulters but offers no such respite to the middle class reeling under the EMI burden,” he said.

According to Dubey, the new RBI rule was against the earlier policy of the central ban. The Bank Officers Federation and the All-India Bank Employees Association, which have 6 lakh members, oppose the new policy.

“The bank staff association has opposed the new rule saying it will not only lead to erosion of public trust in banking but undermine the confidence of the depositors. The bank officers have also said that the move involves a moral hazard as it would encourage the willful defaulters,” he said.

Also read: ED, CBI after Opposition but Interpol gives lifesaver to Mehul Choksi: Congress

Talking about an earlier RBI policy, the Congress leader said that the central bank had banned the entry of willful defaulters into the stock exchange and from taking fresh loans from the banks. “But this rule has now been waived. The willful defaulters have been allowed a cooling period of 12 months. What led the RBI to do a 180-degree turnaround in its earlier policy?” he said.

The Congress leader further said that last year the government had mentioned a list of the top 15 defaulters in a reply to a query in the Lok Sabha and the name of Mehul Choksi, who owns Gitanjali Gems, and Nirav Modi figured prominently among others. “The amount these top 15 defaulters owed to the banks was worth Rs 95,000 crores. This is public money,” he said.

According to the Congress leader, the banks have written off loans worth Rs 10 lakh crore but the recovery has been just 13 per cent. "The NPAs of the banks have gone up significantly during the Modi government compared to the UPA government. The NPAs under UPA were Rs 23,000 crores which are now Rs 40,000 crores,” he said.

Dubey charged that the number of bank frauds had also increased 17 times during the Modi government. “The bank frauds from 2005 to 2014 were worth Rs 35,000 crore but from 2015 to 2023, they are worth Rs 6 lakh crores. This impacts the common man also as the money in the banks is the money of the small investors,” he said.

“This shows the intent of the Modi government. While there is no relief to the common man, the willful defaulters are being offered a safe passage. We want RBI and the Centre to come clean on the new policy,” he added.

Also read: Congress accuses Modi govt of economic mismanagement, demands white paper