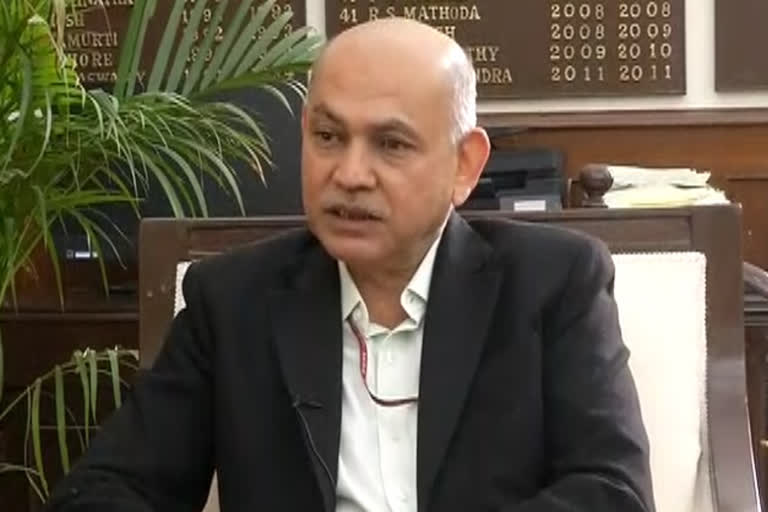

Interview with CBDT Chairman PC Mody ETV Bharat:How difficult it has been to meet revenue collection targets?

CBDT:Entire income tax team rose to the occasion and maximised the collection as they could and at the same time we were sensitive to the needs of the taxpayers. It required some sort of sensitive handling of taxpayers. They were always available to the rescue of the taxpayers.

ETV Bharat: 'Vivad Se Vishwas' scheme was helpful in mobilising revenue?

CBDT:The intent of 'Vivad Se Vishwas' scheme was never to shore up any revenues per se. The underlying thought behind the scheme was more to reduce the tax litigation which was existing at that point of time.

We had taken a series of measures to reduce the tax litigation, first of all, we increased the monetary limits beyond which the department would not go for further appeal at a higher forum. We subsequently issued several circulars to accept the view taken by judicial authorities and in continuation of that series of schemes we also allowed taxpayers to settle their disputes in a short period of time. Of course, the date had to be extended due to Covid.

ETV Bharat:Will the scheme be extended?

CBDT: There will be no occasion to extend 'Vivad Se Vishwas' to next financial year.

ETV Bharat:Whether the Board faced opposition from officers in the implementation of faceless assessment scheme?

CBDT:Let me dispel the so-called dissatisfaction within my ranks to the new scheme, there was none of it. In fact, there were legitimate concerns about what would be the new role.

We held a number of webinars with our own officers and staff and once they understood the intent and the mechanism of the scheme, thereafter there were no such concerns and the scheme has been rolling out very successfully.

ETV Bharat:How confident are you about meeting tax collection targets?

CBDT:Whatever projections have been made in terms of revenue targets, they are a very realistic target for the current year and also for the succeeding year, the revised estimates and the budget estimates for the next year.

Being realistic, we are very confident that we will be able to achieve this.

ETV Bharat:Why tax rates were not cut when studies show tax rate cut leads to buoyancy in the collection?

CBDT: So far the rationalization of tax rates and tax slabs are concerned, we have already done that in the last budget.

At the present juncture, we never felt that we should go for any further tinkering with the tax rates and slabs, whatever has already been prescribed, we would rather prefer that it settles down. And frequent tinkering also creates uncertainty in the minds of taxpayers, this is what we did not want to attempt.

ETV Bharat:What part of the decline in tax collection is attributable to Covid and what to other factors?

CBDT: We have a collection monitoring which we review periodically but to ascribe it purely to one factor would not be appropriate. Of course, the pandemic has its own severe impact, at that time, the improvement in tax administration and ease of tax compliance mitigated the adverse impact.

ETV Bharat:Tax collection from tech giants such as Google, Facebook, Microsoft and others are not commensurate with their scale of business in the country despite the levy of Equalisation Levy.

CBDT:Equalisation levy was levied precisely in that context, e-commerce players and others were accessing the Indian market but were not paying any taxes and to create a level playing field we introduced this equalisation levy, whatever little doubts or concerns were there, we tried to clarify them in the budget.

ETV Bharat:Are we talking to other countries like France who are facing similar issues?

CBDT:That kind of dialogue is always there but not particularly in reference to this issue. A constant dialogue is there with other jurisdictions in other matters. In any case, India has taken the lead on this particular issue.

ETV Bharat:There is 30-35% decline in income tax, corporation tax collection?

CBDT:This decline in the corporate tax collection is also attributable to a rationalization of tax rates in the last budget. The normalcy is there so we expect that very soon corporate tax collection will also be moving up.

ETV Bharat:After faceless assessment what other taxpayer-friendly measures would follow?

CBDT:So far compliance is concerned, we are trying to make available to the taxpayers whatever information we collect from taxpayers in the account of taxpayers on the e-filing portal, which he can see before filing the income tax returns so that they are proper and accurate.

It also enables us to pre-fill the forms for taxpayers, in such cases when the returns are filed properly, there will be very few cases of mismatch and consequently, the number of cases picked up for scrutiny will be much lesser.

Even if the returns are picked up for scrutiny, they are being dealt with in a faceless manner. That should bring a lot of comfort to taxpayers, in terms of compliance. He need not visit any income tax office and he can reply to our notices at his own comfort.

Even after that if some issue remains that is not resolved then the appellate process is also faceless. So we are trying to give an end to end better experience to the taxpayers, the whole idea is that he is motivated to comply with tax laws voluntarily and even if in case of any mismatch which has been generated by the system which he has to answer, they are answered in a very convenient and smooth environment.

We are committed to providing increased services to taxpayers with the hope that he also comes forward and discharges his tax obligations in equal measure.

ETV Bharat:Will the pre-fill facility offered to senior citizen taxpayers be extended to cover their savings in other banks, post offices?

CBDT:For the present, whatever provisions we have brought is for the person who receives pension income and interest income from the same bank.