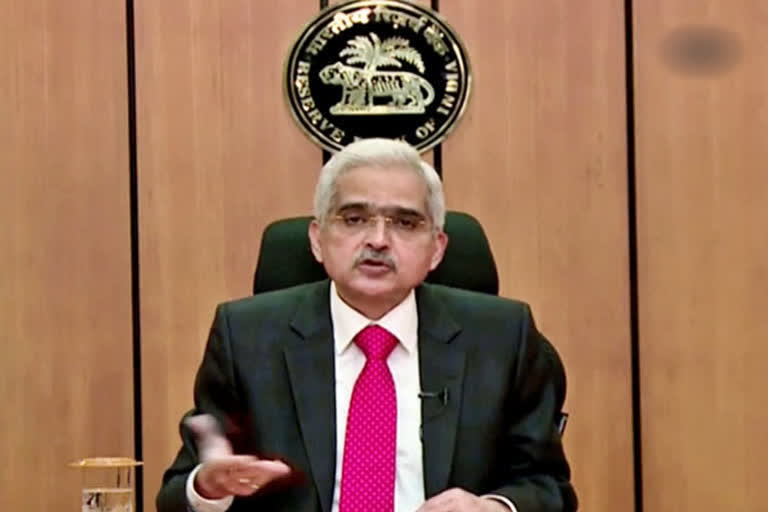

Mumbai: As banks in India are staring at a possible surge in bad loans due to the Covid-19-induced disruptions, the Governor of Reserve Bank of India (RBI) Shaktikanta Das has assured that the Central Bank is keeping a close tab on the financial condition of banks and will take steps to preserve the stability of country's financial system.

In the foreword to the Financial Stability Report (FSR) released on Monday, the Governor also underscored the importance of the banking system as the economy is showing signs of recovery.

“Banks will be called to meet the funding requirements of the economy as it traces a revival from the pandemic. Consequently, maintaining the health of the banking sector remains a policy priority and preservation of the stability of the financial system is an overarching goal,” said the Governor.

This assurance from the Governor is of importance in the backdrop of a probable spike in nonperforming assets (NPAs) of banks in the coming months.

As per the FSR, gross NPAs (GNPAs) of scheduled commercial banks may rise to 13.5 per cent by September 2021, from 7.5 per cent in September 2020 under the baseline scenario.

If the macroeconomic environment worsens into a severe stress scenario, the GNPA ratio may escalate to 14.8 per cent, the FSR added.

The report further mentioned that NPAs of public sector banks will be higher than that of the private banks.

READ: M-cap of BSE-listed companies zoom to fresh record high