New Delhi: Finance Minister Nirmala Sitharaman on Friday presented the Bharatiya Janta Party-led National Democratic Alliance government's maiden budget in the 17th Lok Sabha after assuming power for a second consecutive term. Prior to the presentation, the Union Cabinet headed by Prime Minister Narendra Modi approved the Budget for 2019-20.

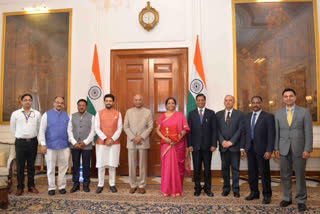

Sitharaman, the second woman in the history of Independent India to present the Union Budget, handed over a copy of the Union Budget to President Ram Nath Kovind before her maiden budget speech. Breaking away from the red Budget briefcase, Sitharaman held a red parcel like a bag with a keyhole on the emblem signifying the traditional 'Bahi Khata'.

Former Prime Minister Indira Gandhi was the first and only woman till now to have presented the Union Budget. In 1970, she presented the Union Budget of India for 1970-71, after she took over the finance portfolio following the resignation of Morarji Desai as finance minister.

Here is a sector-wise division of all the Budgetary sops announced by Sitharaman:

Key highlights of Union Budget 2019 - Finance Minister Nirmala Sitharaman announced a slew of steps to scale up India's infrastructure including augmenting 1,25,000 km of rural roads under the Pradhan Mantri Gram Sadak Yojana at a cost of Rs 80,250 crore and creating a national highways grid.

Budgetary sops for Infrastructure development - In the industrial sector, the government has made a slew of proposals including the extension of pension benefit to three crore retail traders with an annual turnover less than Rs 1.5 crore under Pradhan Mantri Karam Yogi Maandhan Scheme.

Budgetary sops for industrial development - With the economic growth of the country going as low as 5.8 per cent in 2018-19, Sitharaman has set a target of making the Indian economy a $5 trillion economy in a few years.

Budgetary sops for economic development - Sitharaman made a number of tax proposals but stayed away from announcing any changes in personal income tax

Tax proposals made in the Union Budget 2019 - In a bid to transform rural India, the Finance Minister put forth proposals including setting up of 100 clusters for traditional industries to enable 50,000 artisans to join the economic value chain.

Budgetary sops for rural development - With a NITI Aayog report claiming that Twenty one cities in India will run out of groundwater by 2020 and 40 per cent of India's population will have no access to drinking water by 2030, sops pertaining to water security were much expected from this budget. Several proposals were also made for farmer's welfare.

budgetary sops for water management and farmer's welfare - Several proposals have also been made to empower the women of the country.

Budgetary sops announced for women empowerment - In the education sector, the government pitched the idea of making India a global hub of higher education.

Budgetary sops announced for the education sector - Among a range of sops aimed at the welfare of labour force and the youth, a significant announcement includes rationalising of labour laws into 4 labour codes proposed.

Budgetary sops for the labour force and the youth - The government has also announced several other measures meant to enhance the country's infrastructure, including the establishment of a Credit Guarantee Enhancement Corporation in 2019-20.

Budgetary sops for Infrastructure development - Sitharaman also spoke about fiscal consolidation and inflation management.

Budgetary measures for fiscal consolidation and inflation management - Budgetary sops with respect to banking and Goods and Services Tax were also announced. The Finance Minister also proposed the expansion of Swachh Bharat Mission to undertake sustainable solid waste management in every village.

Budgetary sops with respect to banking and Goods and Services Tax, Banking and Swachh Bharat Mission - The Railway budget proposed the idea of encouraging investment in suburban rail network via special purpose vehicles (SPVs) and enhancing metro rail network through public-private partnerships.

Railway budget at a glance - Sitharaman also presented a 'Vision' document laying out a framework for developmental work for the next decade.

Vision for 'New India' presented in the budget