New Delhi: In the 54th meeting, the GST Council recommended several significant measures to enhance the overall GST framework. A new Group of Ministers (GoM) will be formed to address life and health insurance issues, working alongside the existing Rate Rationalisation GoM, officials said.

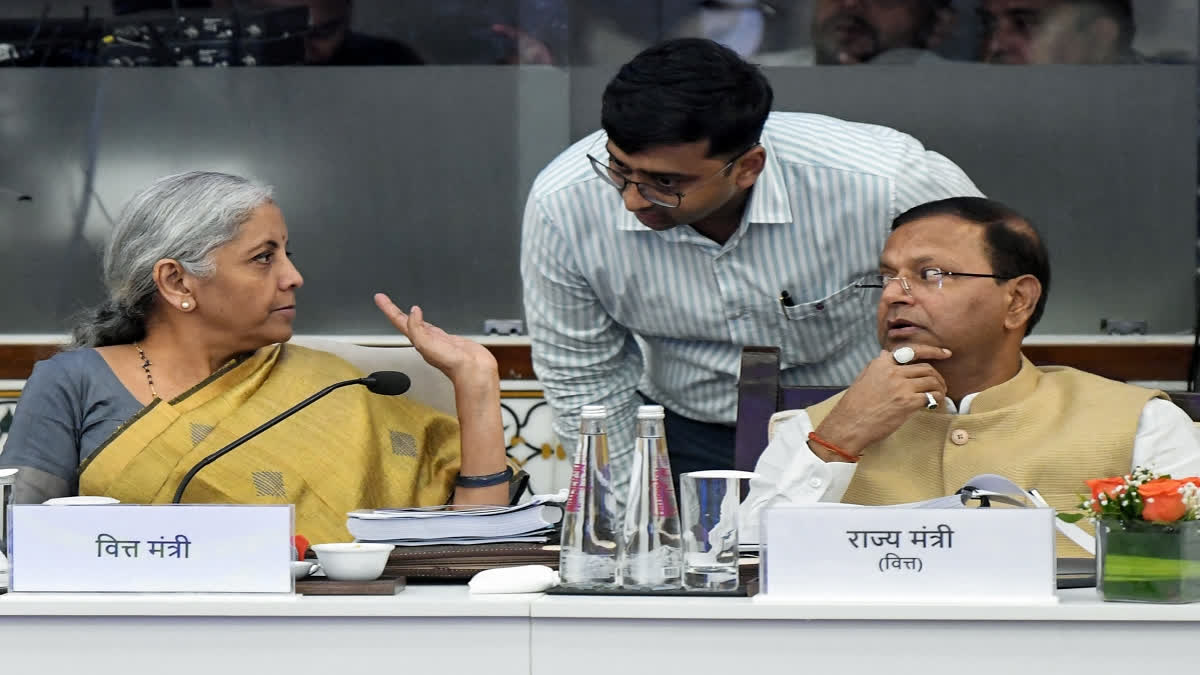

It will submit a report by October 2024. Another GoM is going to study the future of the compensation cess, they added. The GST Council met under the Chairpersonship of Union Finance & Corporate Affairs Minister Nirmala Sitharaman here on Monday.

After the meeting, the Finance Minister said that the Council also proposed exempting R&D services provided by specific institutions funded by government or private grants from GST. Additionally, it recommended reducing GST rates on key cancer drugs — Trastuzumab Deruxtecan, Osimertinib, and Durvalumab — from 12% to 5%.

"Lastly, a pilot for Business-to-Consumer (B2C) e-Invoicing will be rolled out to streamline invoicing and improve compliance", she added.

Changes GST Tax Rates

According to Nirmala Sitharaman, the GST rate of extruded or expanded products, savoury or salted (other than unfried or un-cooked snack pellets, by whatever name called, manufactured through a process of extrusion), to be reduced from 18% to 12% at par with nankeens, bhujia, mixture, chabena (pre-packaged and labelled) and similar edible preparations in ready for consumption. The GST rate of 5% will continue on un-fried or uncooked snack pellets, by whatever name called, manufactured through the process of extrusion.

The GST Council also recommended to exempt the supply of research and development services by a Government Entity; or a research association, university, college or other institution notified u/s 35 of the Income Tax Act using government or private grants.

The Council also decided that the GST rate on cancer drugs namely, Trastuzumab Deruxtecan, Osimertinib and Durvalumab be reduced from 12% to 5%. Besides this GST rate on car seats classifiable under 9401 to be increased from 18% to 28%. This uniform rate of 28% will be applicable prospectively for car seats of motor cars in order to bring parity with seats of motorcycles. It is already attracting a GST rate of 28%.

On Insurance

The GST Council also recommended to constitute a Group of Ministers (GoM) to holistically look into the issues pertaining to GST on life insurance and health insurance. The GoM members are Uttar Pradesh, Bihar, West Bengal, Kerala, Rajasthan, Andhra Pradesh, Karnataka, Meghalaya, Goa, Telangana, Tamil Nadu, Punjab, and Gujarat. The GoM will submit the report by the end of October 2024.

Besides this Council recommended to notify GST at 5% on the transport of passengers by helicopters on seat share basis and to regularise the GST for past-period on 'as is where is' basis. Revenue Secretary Sanjay Malhotra also clarified that the charter of helicopters will continue to attract 18% GST.

The Finance Minister also said that the issue of compensation cess beyond March 2026 will be decided by the GoM. According to her, the GoM would take a call on the additional Rs 40,000 crore collected after adjusting for loans and interest. The compensation cess is likely to set off the loan and cess amount by January 2026, while the cess will continue till March 2026.