By Saurabh Shukla

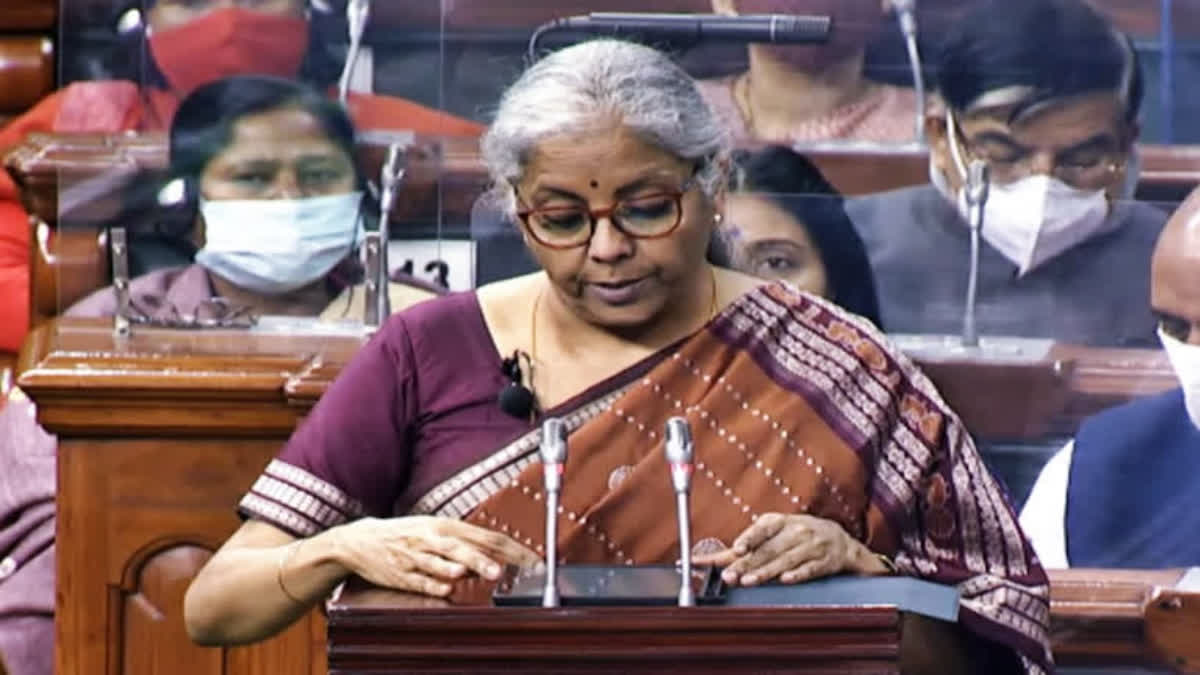

New Delhi:After presenting her 8th budget, Finance Minister Nirmala Sitharaman said that we have done reforms regarding income tax and the bill is scheduled for next week's parliament session. She said that with the announcement of tax reduction under the new regime, there will be no reduction to the capital expenditures and fiscal prudence has been maintained.

Addressing a press conference here, she also added that in the proposed new tax regime, the maximum total income for which tax liability for individual taxpayers is NIL is Rs 12.75. Earlier the limit of income for nil tax payment was Rs 7 lakh. By increasing this limit to Rs 12 lakh around one crore assessees, who were earlier required to pay tax varying from Rs 20,000 to 80,000 will be now paying nil tax. And more than one crore people are going to benefit and will pay no tax.

As per the government, the benefit of such Nil tax liability mentioned above is available only in the new tax regime. This New tax regime is the default regime. To avail of the benefit of rebate allowable under proposed provisions of the new tax regime, only a return is to be filed otherwise no other step is required to be taken.

Revenue Secretary Tuhin Kanta Pandey said that any individual earlier was required to pay a tax of Rs 80,000 (in the new regime) for an income of Rs 12 lakh, now he will be required to pay nil tax on such income.